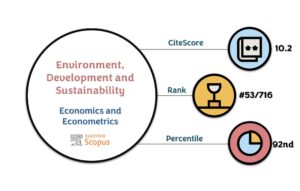

Ali M, Seraj M, Turuc F, Tursoy T, Uktamov KF. Green finance investment and climate change mitigation in OECD-15 European countries: RALS and QARDL evidence. Environment, Development and Sustainability. 2024, 26:27409–27429.

The research investigates the role of green finance in addressing climate change challenges. The study emphasizes the urgent need for sustainable investments to achieve climate goals and examines how green finance impacts carbon emissions across OECD-15 European countries. Using advanced econometric models, the authors assess the relationship between green finance, renewable energy consumption, economic growth, and carbon emissions from 1990 to 2020.

Key findings indicate that increased green finance investments significantly reduce carbon emissions, demonstrating the potential of sustainable financial tools in climate change mitigation. Moreover, renewable energy consumption is found to be a crucial factor in lowering emissions, reinforcing the importance of transitioning to clean energy sources. However, the study also highlights that unchecked economic growth can lead to increased emissions, suggesting a need for balanced policies that prioritize sustainability.

The research underscores the importance of government interventions, such as subsidies for renewable energy and incentives for green investments, to enhance the effectiveness of green finance. Additionally, the findings advocate for stronger international cooperation among OECD countries to align climate strategies and share best practices.

In conclusion, the study provides valuable insights into the critical role of green finance in combating climate change and offers actionable recommendations for policymakers. It stresses the importance of integrating financial, environmental, and energy policies to achieve long-term sustainability goals, positioning green finance as a cornerstone of global climate action.

Dr. Mehdi Seraj is an associate professor of Economics and an academic member of Near East University Faculty of Economics and Administrative Sciences. For those interested in pursuing research or collaborations in the field of green finance, economic development, and climate change mitigation, Dr. Mehdi Seraj ([email protected]) is available for inquiries. With expertise in sustainable investments and environmental policy, Dr. Seraj provides valuable insights and guidance for advancing work in this important area.

Abstract

Green finance is an organized financial activity meant to improve the environment. Regardless of its critical role in mitigating climate change, green finance faces a significant investment shortfall. Green financing is a feasible way to close the gap in green investment. Despite the potential benefits of green finance in green renewable energy technologies, this study topic has received little attention. Investment in green energy projects draws attention since it eliminates the negative consequences of fossil fuels while also conserving the environment. This research looks into the nexus between investments in green finance, renewable energy consumption, carbon dioxide, foreign direct investment, remittances, inflation, gross fixed capital formation, trade openness, and human capital for the OECD-15 European countries, utilizing newly developed “Residual Augmented Least Squire” (RALS) cointegration technique and the QARDL model for the period spanning from 1990 to 2020. In empirical results, the RALS cointegration test confirms the cointegration link between the studied antecedents. Additionally, “Quantile Autoregressive Distributed Lag Mondel” (QARDL) empirical estimates show that the lag of renewable energy consumption, foreign direct investment, gross capital creation, trade openness, and human capital all have substantial influence on green finance investment. Carbon dioxide emissions and inflation, on the other hand, are proven to be adversely related. However, remittances have a negligible relationship with green finance investment. The results of this research provide insightful information on the state of green finance investments now and their requirements in the future. These insights will be beneficial for researchers, policymakers, and practitioners as they work towards enhancing and advocating for the implementation of green finance investment initiatives and endeavors aimed at mitigating climate change.